Malaysia Corporate Tax Rate 2018

In budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for ya 2017 and 2018.

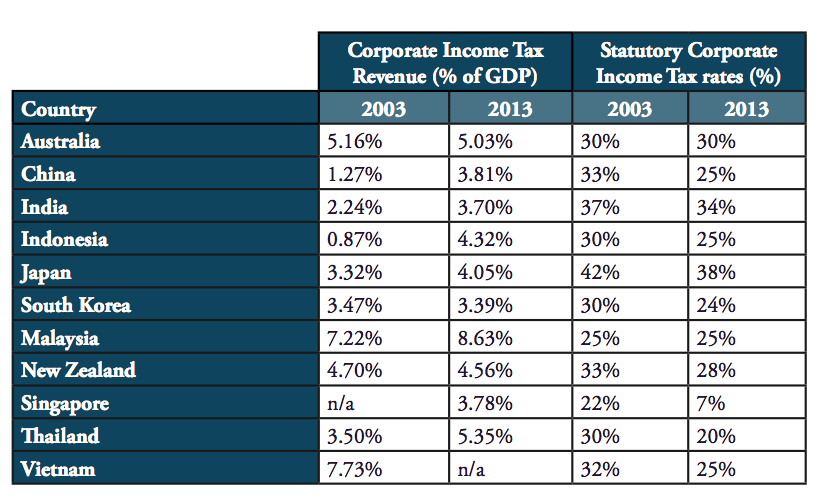

Malaysia corporate tax rate 2018. Companies capitalized at myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance taxed at the 24 rate. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Chargeable income myr cit rate for year of assessment 2019 2020. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

Year assessment 2017 2018. The standard corporate tax rate is 24 while the rate for resident and malaysian incorporated small and medium sized companies smes i e. The corporate tax rate in malaysia stands at 24 percent. The current cit rates are provided in the following table.

Semua harga di atas akan dikenakan cukai perkhidmatan malaysia pada 6 bermula 1 september 2018. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Company with paid up capital more than rm2 5 million. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar.

Tax rate corporate companies are taxed at the rate of 24. Corporate tax rate will be reduced to 17 from 18 for smes with paid capital below rm2 5m and businesses with annual taxable income below rm500 000. 2018 2019 malaysian tax booklet 22 rates of tax 1. Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5 400 000 83 650 25 600 000 133 650 26 1 000 000 237 650 28 a qualified person defined who is a.