Malaysia Personal Income Tax Rate

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

Malaysia personal income tax rate. What is a tax exemption. The personal income tax rate in malaysia stands at 30 percent. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia.

What is a tax deduction. Cukai rm 0 5 000. Malaysia personal income tax rate. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

What is tax rebate. Pengiraan rm kadar. The tax rate in malaysia is always a. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500.

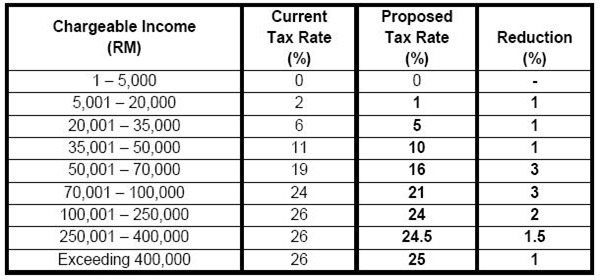

The following rates are applicable to resident individual taxpayers for ya 2020. Taxpayers only pay the higher rate on the amount above the rate. What is chargeable income. Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015.

Malaysia personal income tax rate. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Green technology educational services healthcare.

Box 10192 50706 kuala lumpur malaysia tel. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. Personal income tax rates. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

This page provides malaysia personal income tax rate actual values historical data forecast chart statistics economic calendar and news. The income tax rates are on chargeable income not salary or total income and chargeable income is calculated only after tax exemptions and tax reliefs. Malaysia adopts a progressive income tax rate system. For example let s say your annual taxable income is rm48 000.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Income tax rates 2020 malaysia. Malaysia personal income tax guide for 2020.