Partnership Income Tax Computation Malaysia

Llp have a similar tax treatment like company where chargeable income from llp will be taxed at the llp level at tax rate of 24 generally.

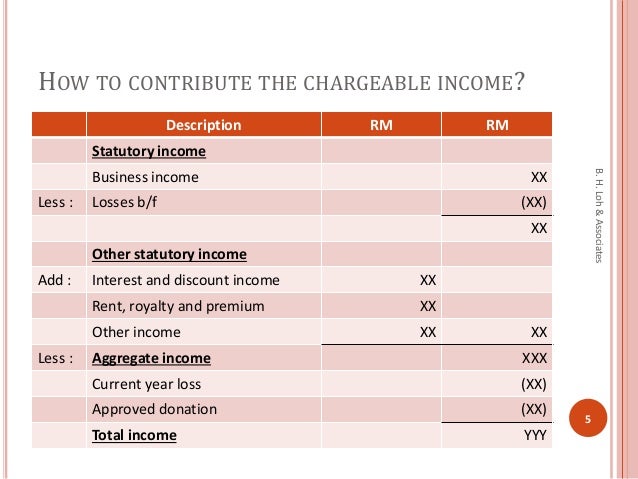

Partnership income tax computation malaysia. In malaysia partnership income is s 4 a business income. To check and sign duly completed income tax return form. 9 order 2002 p u. Income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

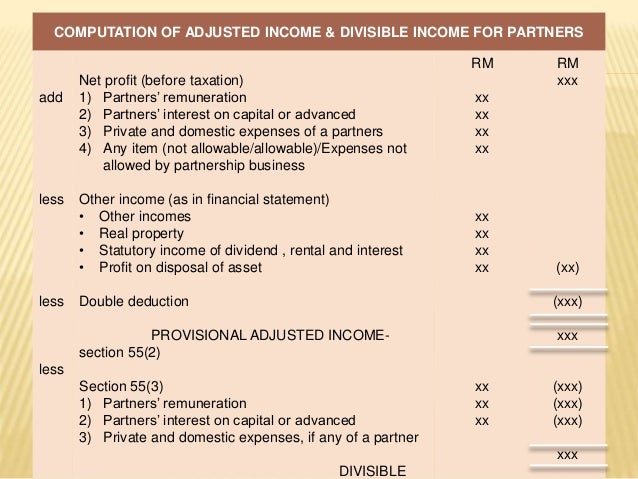

To submit the income tax return form by the due date. Line 22 shows ordinary income net income for the partnership income minus deductions. This means that low income earners are imposed with a lower tax rate compared to those with a higher income. Income the tax of partnership does not exist simply because it is not a chargeable person to pay income tax but it is a chargeable person of real property gains tax act 1976 rpgt where the gain occur from disposal of real property and the profits is not a joint liability of the.

Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. The last part calculates taxes due. Income attributable to a labuan business activity of labuan entities including the branch. It is important to know that in the situation of a llp that is registered in malaysia the income tax will be applied at a rate of 20 provided that the capital contribution of the partnership is of maximum rm 2 5 million.

Tax treatment of llp. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Company while registered companies are subject to corporate tax other types of businesses such as sole proprietorships and partnerships are also liable to income tax. The first part reports the income of the partnership including the calculation of cost of goods sold if the partnership sells products.

The second part lists deductions for business expenses. To compute their tax payable. A direct tax is a tax that is levied on a person or company s income and wealth. The system is thus based on the taxpayer s ability to pay.

The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. Refer to paragraphs 2 3 and 6 of the income tax exemption no. A 57 and income tax exemption amendment order 2006 p u a 275 to determine the eligibility. The tax is paid directly to the government.

Melayu malay 简体中文 chinese simplified taxation for limited liability partnership llp in malaysia. Partnership 1 pertaining to each business partnership by using attachment s and submit together with the form p. Husband and wife have to fill separate income tax return forms. For partnerships income is distributed to partners for individual tax computation sole proprietorship partnership vs.

Examples of direct tax are income tax and real property gains tax.

%202.png)