Rate Of Contribution Socso

Employers in the private sector experiencing a fall in income of more than 50 since jan 1 2020 will be able to claim rm600 per worker limited to 100 workers earning below rm4 000 and contributing to eis for three months.

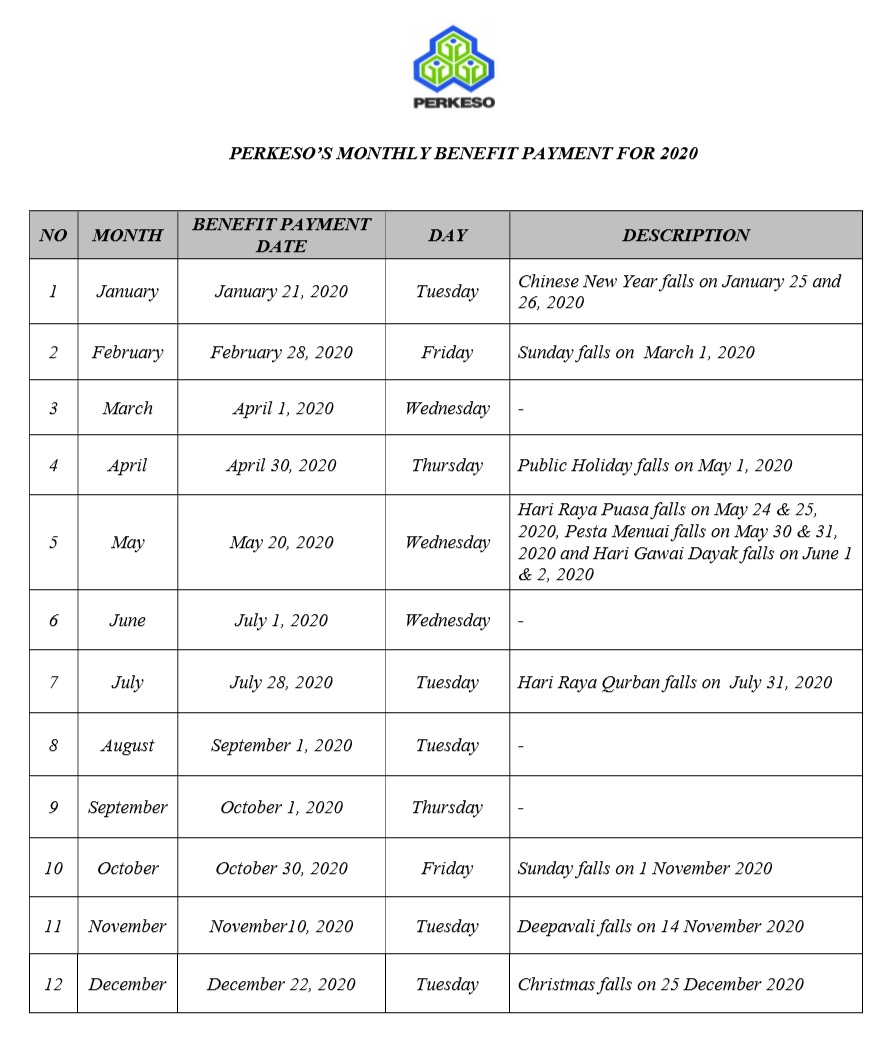

Rate of contribution socso. This measure is to avoid employers from retrenching employees during covid 19 economic downturn. Disclaimer socso is not responsible for any damage or loss caused by using the information in this website. All employees who have reached the age of 60 must be covered under this category for the employment injury scheme only. On 1 january 2018 socso introduced perkeso assist portal to facilitate employers to manage their registration update records and contribution payments.

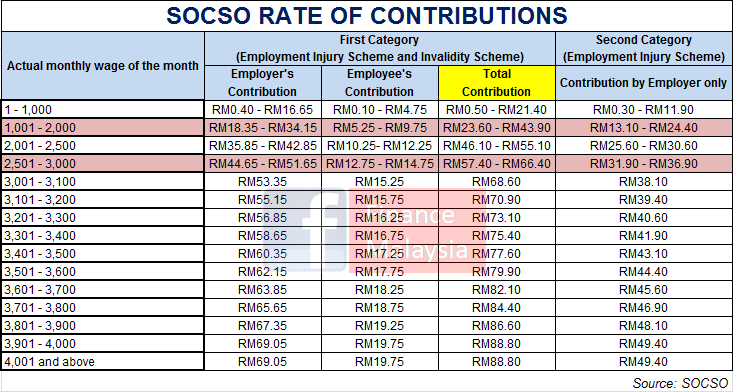

To use perkeso assist portal employers need to register to obtain the id for the assist portal by filling in the form for perkeso assist portal. Rate of contributions rate of contributions em ployment injury scheme and invalidity employment injury em ployer s employee s contribution by contribution contribution contribution employer only wages up to rm30. Both the rates of contribution are based on the total monthly wages paid to the employee and contributions should be made from the first month the employee is employed. Mozilla firefox and google chrome.

A company is required to contribute socso for its staff workers according to the socso contribution table rates as determined by the act. In the first category for the most part the employer is to pay 1 75 of the employee s total salary towards the fund and the employee is to pay 0 5 of their salary amount towards the fund. Rate of contribution payment of contribution. The amount paid is calculated at 0 5 of the employee s monthly earnings according to 24 wage classes as in the contribution table rates below along with the 1 75 contribution of the monthly payroll from the employer.

1024 x 768 browser. The company will pay 1 75 while the staff workers will contribute 0 5 of their wages for the employment injury insurance scheme and the invalidity pension scheme. The rate of contribution under this category is 1 25 of employees monthly wages payable by the employer based on the contribution schedule. Then the total amount is the addition of these two and will go towards the socso fund.

Rate of contributions author.