Secretarial Fee Tax Deduction Malaysia 2018

This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019.

Secretarial fee tax deduction malaysia 2018. Section 26 of the sales tax act 2018. Bijak secretarial services sdn bhd setiausaha syarikat berdaftar di bawah as 1965 pada 1 6 2016 sebanyak rm1 000. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the.

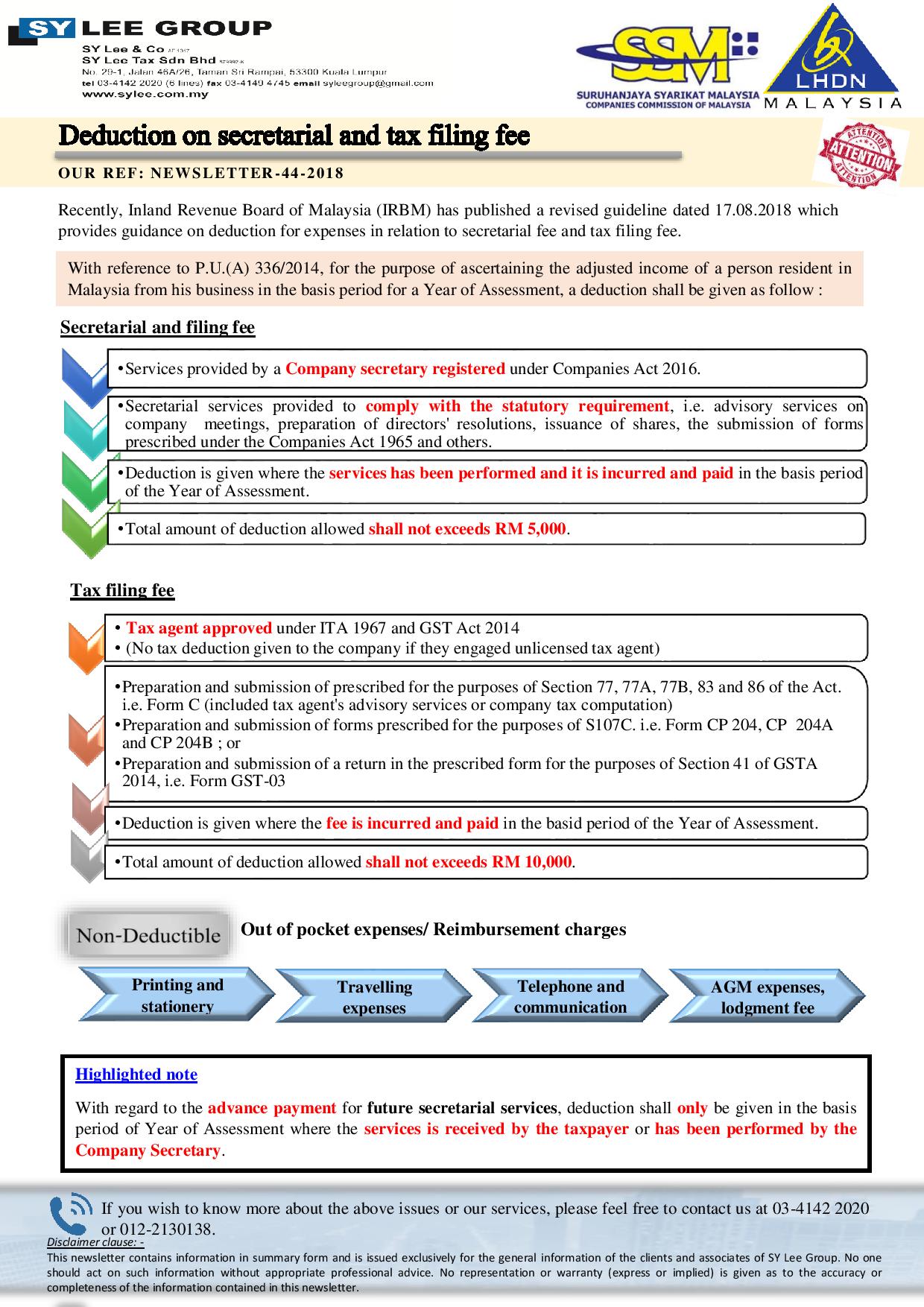

Malaysia corporate deductions last reviewed 01 july 2020. B cost of appeal against income tax assessment i e. With this the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u. 6 4 income tax returns a cost of filing of tax returns and tax computations.

Section 19 of the departure levy act 2019. Section 19 of the tourism tax act 2017. The effective date of each relevant paragraph in a public ruling follows the effective date of the related provisions in the income tax act 1967 income tax exemption income orders or income tax rules. 6 5 legal expense incurred by a landlord.

B annual general meeting expenses. Following the issuance of a guideline for deduction of secretarial and tax filing fees dated 17 august 2018 numerous clarification had been sought by taxpayers and professional bodies on the uncertainty in relation to the deductibility of such fees. A 336 are revoked. The inland revenue board of malaysia irbm has on 17 august 2018 issued a 2nd amended guidelines on deduction for expenses in relation to secretarial fee and tax filing fee revised as at 17 08 2018 relating to the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u.

Syarikat anggun sdn bhd telah membuat bayaran pada 1 7 2016. For ya 2017 and ya 2018 companies will be eligible for a reduction of between 1 and 4 on the standard tax rate for a portion of their income if there is an increase of 5 or more in the company s chargeable income compared to the immediately preceding ya. The inland revenue board irb has issued its guideline dated 8 february 2017 on the tax deductionof secretarial and tax filing fees under the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 the rules. Amended guideline on deduction for expenses relating to secretarial fees and tax filing fees.

Inland revenue board of malaysia. Section 26 of the service tax act 2018. The guideline explains the tax treatment for deductionof secretarial and filing fees. To the special commissioners of income tax and the courts.

%20order%202017-page-001.jpg)

(amendment)%20rules%202019-page-001.jpg)