Sip Eis Contribution Table 2019 Pdf

What s new for 2019 retirement savings contributions credit.

Sip eis contribution table 2019 pdf. With the latest update from perkeso user has to submit the eis contribution amount follow the steps here. The user may print or export the lampiran 1 format from the system. Disclaimer socso is not responsible for any damage or loss caused by using the information in this website. Refer to eis ratio table since the total is 4100 then below is the eis amount deducted.

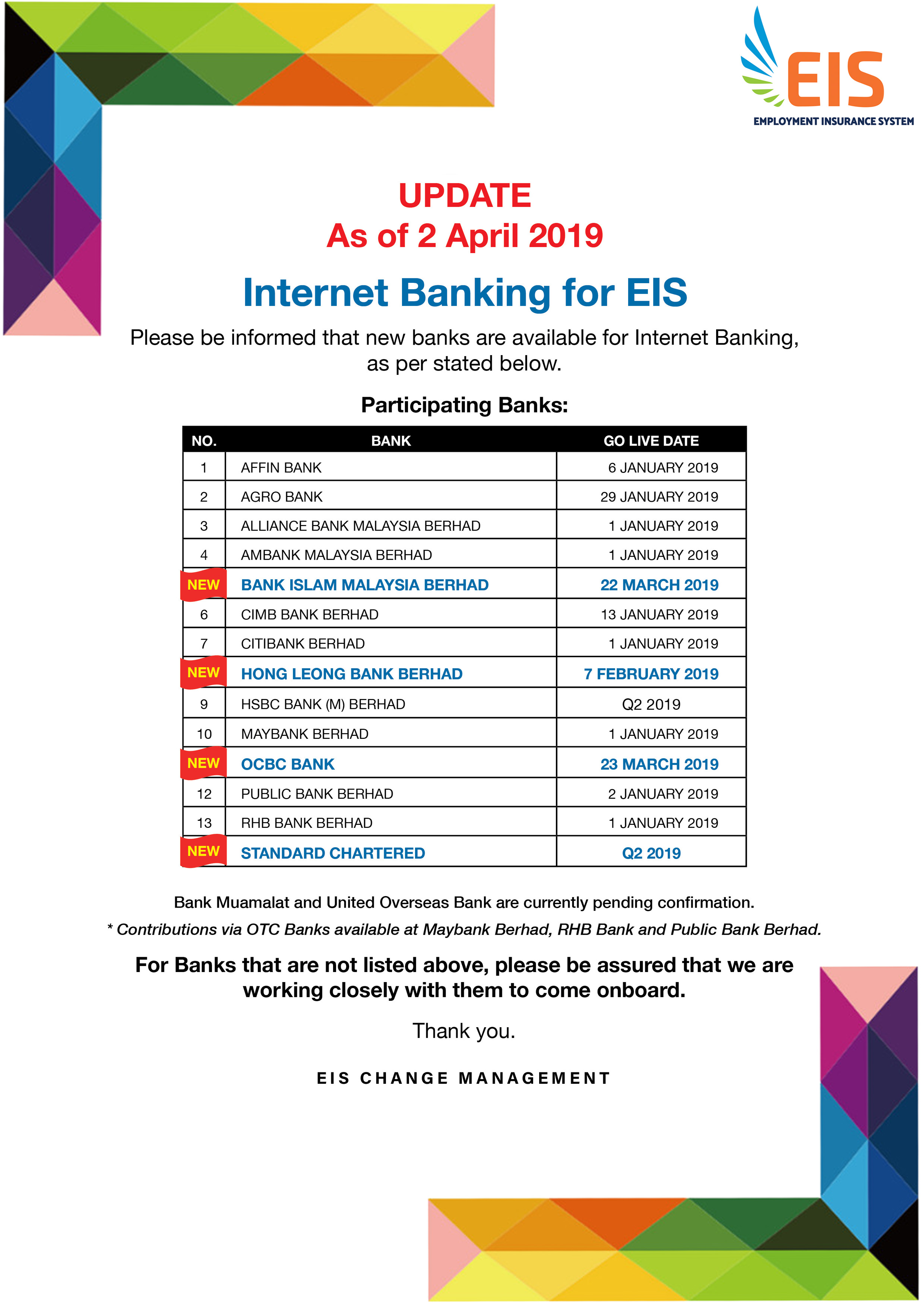

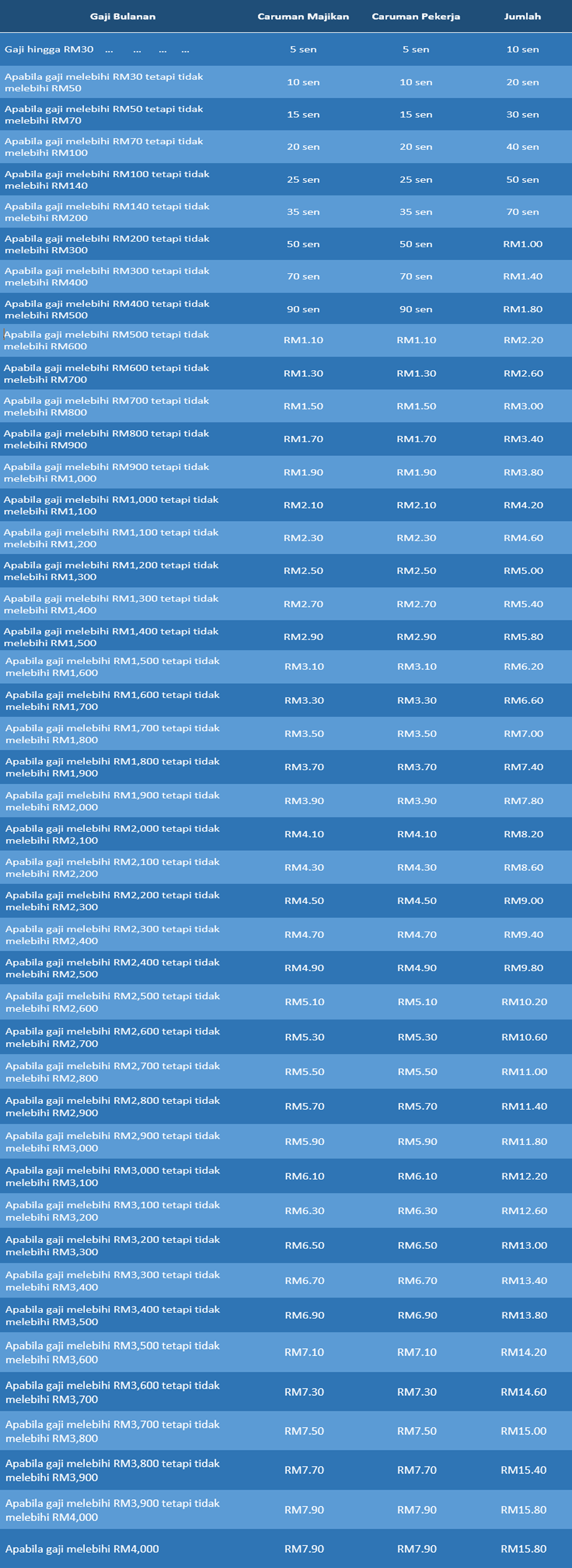

Under the ra no. Latest update by 20th march 2019. The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. Sedia maklum kadar caruman bagi sistem insuran pekerjaan sip adalah daripada 0 2 syer majikan dan 0 2 syer pekerja daripada gaji bulanan pekerja.

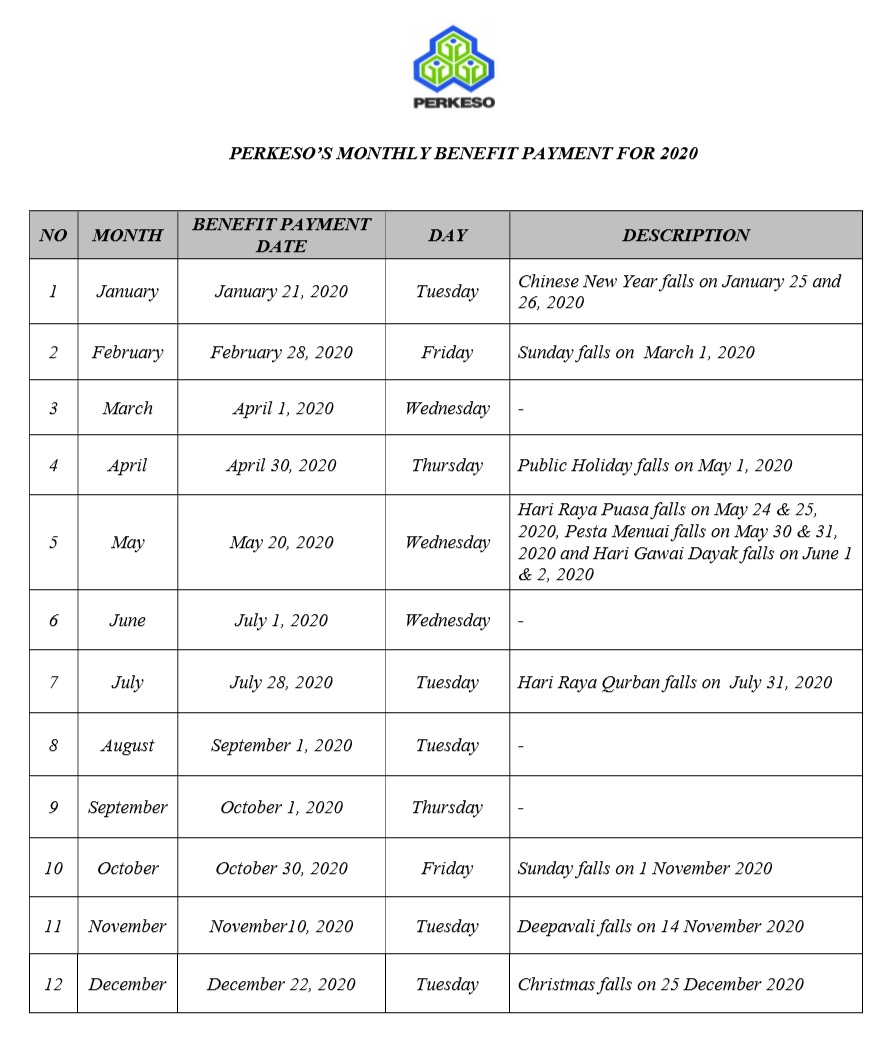

To compute how much you have to pay as an employee or employer use the pag ibig contribution table above and this formula. New sss contribution table 2019 for household employers kasambahays and ofw members. Jadual caruman sip perkeso 2020 kadar berikut dikongsikan maklumat berkaitan jadual dan kadar caruman sip perkeso tahun 2020. Sip ksm diminta melihat semula kadar caruman dan kemampanan dana ec ke 4 ec bersetuju sip dilaksanakan mulai 1 januari 2018 simulasi kewangan dipersetujui hybrid pelaksanaan dikaji supaya tidak membebankan kerajaan undang undang sip memberi kuasa kepada menteri untuk meminda caruman dan siling gaji etlb dikekalkan dan pembaharuan undang.

Website updated on 25 september 2020. Php 3 000 x 0 02 php 60. Sample computation for a worker with php 3 000 monthly basic salary. 10361 or the domestic workers act or the batas kasambahay the employer pays the entire contribution if the kasambahay earns less than five thousand pesos php 5 000 per month.

Pag ibig contribution monthly basic salary x employee s or employer s contribution rate. Amount of wages rate of contribution for the month for the month by the by the total employer employee contribution rm rm rm rm rm from 1540 01 to 1560 00 188 00 172 00 360 00 from 1560 01 to 1580 00 190 00 174 00 364 00 from 1580 01 to 1600 00 192 00 176 00 368 00 from 1600 01 to 1620 00 195 00 179 00 374 00. The new contribution schedule will be implemented for the applicable month of april and payable in may 2019. All employers in the private sector whose employees are covered under the act are required.

Mozilla firefox and google chrome. 1024 x 768 browser.