Stamp Duty Act Malaysia 2017

Laws of malaysia act 378 stamp act 1949 an act relating to stamp duties.

Stamp duty act malaysia 2017. Stamp amendment act 2017. For the next rm2 000 000. Amcndment of section 3b of the principal act. For the first rm500 000.

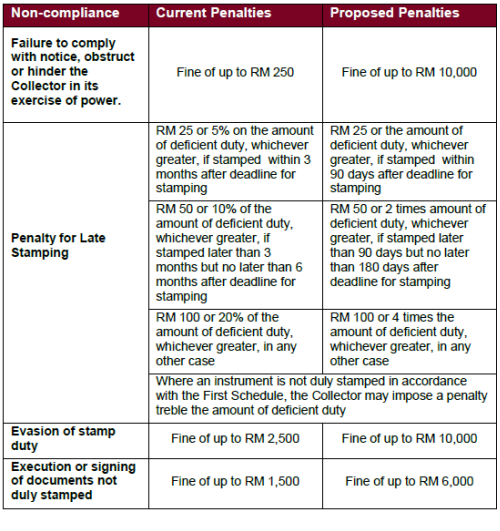

Peninsular malaysia 5 december 1949. Enacted yt e parliament of the bahamas an act to amend the stamp act stamp amendm nt act 2017 section sh01t title. Penalty stamp duty an instrument may be stamped within 30 days of its execution if executed within malaysia or within 30 days after it has been first received in malaysia if it has been executed outside malaysia. 1 subject to a minimum fee of rm500 00 for the next rm500 000.

Companies act 2016 act 777 14 calculation of stamp duty where ad valorem stamp duty is payable the calculation provided in the first schedule will be stated as a percentage instead of the current formulation rmx for every rmy or part thereof. An instrument is required to be stamped within 30 days of its execution if executed within malaysia. B 441 1989 part i preliminary short title and application 1. For first rm100 000 stamp duty fee 2.

Stamp duty rate pre amendment stamp duty rate post amendment first rm 100 000 1 1 rm 100 001 rm 500 000 2 2 rm 500 001 rm 1 000 000 3 3 rm 1 000 001 and above 3 4 instruments falling under item 22 1 in the first schedule prior to the amendments under the fa item 22 1 was earlier amended such. Insertion cfnew section 3c into the principal act. This act shall come into force on the 1st day of july 2017. There are two types of stamp duty namely ad valorem duty and fixed duty.

Stamp amendment act 201 7. 2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. 1 this act may be cited as the stamp act 1949. If the instrument is executed outside malaysia it must be stamped within 30 days after it has been first received in malaysia.

Photo by the edge khairie hisyam aliman january 23 2017 updated 3 years ago. For the next rm2 000 000. Examples of instruments subjected to stamp duty. Sabah and sarawak 1 october 1989 p u.

This appears to simplify the calculation but unfortunately. The bill also contains clauses that increase the inland revenue board s power of collection vis a vis stamp duty. If it is not stamped within the period stipulated a penalty of.